World’s biggest mergers

The buyout of British brewer SABMiller by Budweiser-maker Anheuser-Busch InBev is the third biggest merger in corporate history. If completed, the brewer will make one in three beers sold globally

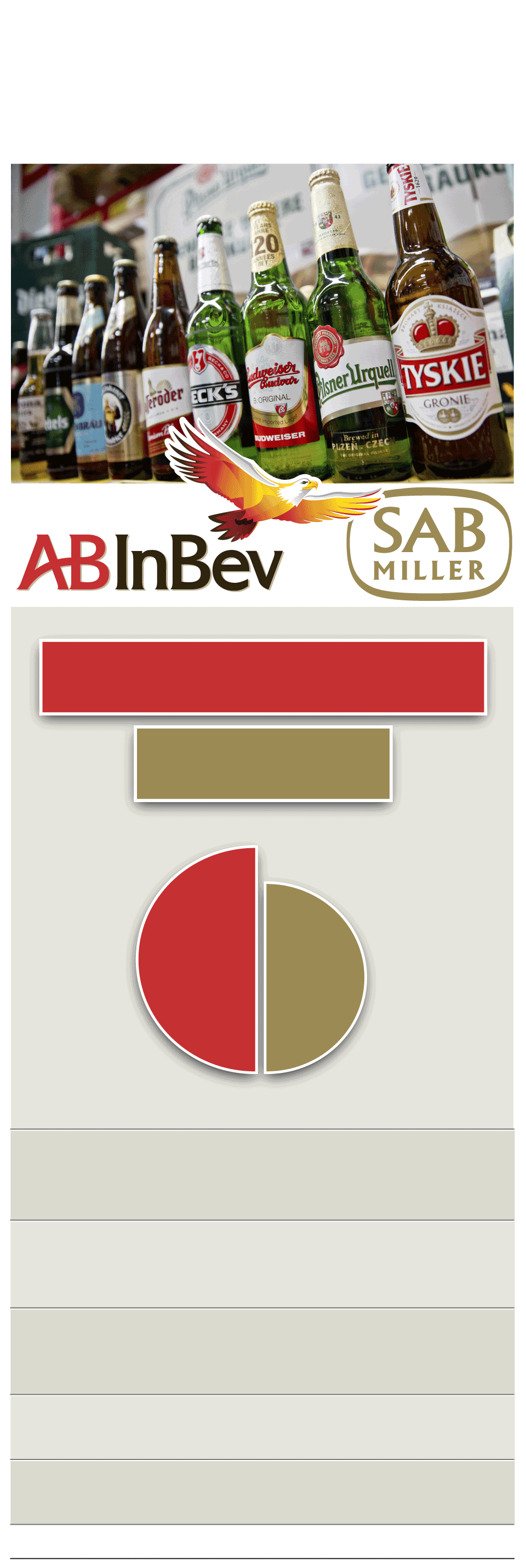

Revenue

($ billions)

$172bn

UK’s

1999:

Vodafone AirTouch PLC

AB InBev*

swallows up German counterpart

47.1

Mannesmann AG

$130.1bn

SABMiller**

(U.S.)

2013:

Verizon Wireless Inc.

26.3

and

(U.S.)

Verizon Communications

Production

(litres billions)

$122bn

(U.S.) “agreement

2015:

AB InBev

in principle” to buy

(UK)

SABMiller

$112.1bn

(U.S.) and

2000:

America Online

45.9

32.4

(U.S.)

Time Warner

$111.8bn

(U.S.) acquires

1999:

Pfizer Inc.

(U.S.)

Warner-Lambert Co.

*Year ended March 2015 **Year ended 2014

Source: Dealogic, company reports

© GRAPHIC NEWS